Nation

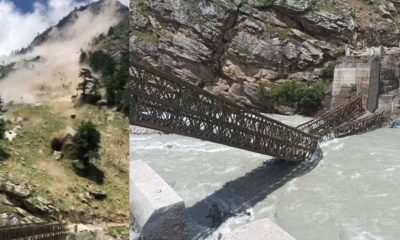

Videos: Uttarakhand ‘Glacier Break’ Triggers Massive Flooding, Several Dead, Over 150 Missing

Uttarakhand-A “glacier break” at Joshimath in Uttarakhand’s Chamoli district today triggered a massive flood in the Alaknanda and Dhauliganga rivers. While A dozen bodies have already been recovered, over 150 people are feared are still missing and feared to be dead. These people are mostly those working inside power projects. About 16 people, who were stuck in a tunnel of Tapovan dam, had been rescued at the time of writing. Efforts were on to rescue others trapped in another tunnel, which was being coordinated by the Army and ITBP. This natural disaster has also triggered debate among ecologists and environmental activists over building too many dams in the Himalayan region.

Videos of this tragic, as well as, horrifying incident have appeared on social media platforms. Videos showed scary scenes of the water tearing through a narrow valley below the power plant and destroying almost everything which came in its spate appeared.

#Uttarakhand_Disaster: #glacier-related disaster. Glacial Lake Outburt Flood (GLOF), same was witnessed in Kedarnath in 2013. More info awaited. #RishiGangaPowerProject destroyed. #Chamoli #PrayersForUttarakhand pic.twitter.com/9iSsptruFi

— Utkarsh Singh (@utkarshs88) February 7, 2021

According to the initial report issued by the Union Government, due to the glacier burst near Joshimath and avalanche, the flow of water increased greatly and first the water level started rising in the Rishiganga River and later in Alaknanda River. The massive flood washed away the Rishiganga small hydro project of 13.2 MW.

Heavy floods turn up in the #Joshimath Region of #Uttarakhand due to breaking up of #JoshimathGlacier today morning. The dams of the rivers also collapsed along with the #RishigangaPowerProject. High alert has been declared in #Rishinagar, #Rishikesh and #Haridwar. pic.twitter.com/h0hogxaSUf

— Mojo Story (@themojostory) February 7, 2021

The flash flood also affected the downstream hydro project of NTPC at Tapovan on the river Dhauliganga, which is a tributary of the river Alaknanda.

Tapovan Power Project damaged after a massive flood in #Chamoli district of #Uttarakhand. pic.twitter.com/yN9mNRUmKi

— SkymetWeather (@SkymetWeather) February 7, 2021

There is no danger of downstream flooding and the rise in water level has been contained, as per the information given by the Central Water Commission (CWC). There is also no threat to the neighbouring villages. At the same time, the concerned agencies of the Centre and the State were asked to keep a strict vigil on the situation, and a team from DRDO, which monitors avalanches, is being flown in for surveillance and reconnaissance. MD, NTPC has been asked to reach the affected site immediately.

search & rescue operation at #Tapovan #RishiGangaPowerProject #Uttarakhand pic.twitter.com/spyy7ElXwJ

— Sanjay Jha (@SanjayJha) February 7, 2021

Rescue and Relief Operations by the Centre and State Government are in full swing and 3 teams of the National Disaster Response Force (NDRF) have reached the spot. More than 200 ITBP personnel are on the spot, and one column and Engineering Task Force (ETF) of Army, with all rescue equipment, have been deployed. Navy divers are being flown in and aircraft/ helicopters of the Indian Air Force (IAF) are on standby.

ITBP personnel carrying rescued persons on stretchers to the nearest road head near Tapovan after rescuing them from the tunnel. #Uttarakhand pic.twitter.com/Spq6OltCY6

— Aditya Raj Kaul (@AdityaRajKaul) February 7, 2021

“We are focusing on the second tunnel, that is tunnel number one, we’ve learnt that around 30 people are trapped there. We will be carrying out night operations also. Our teams are already on the job and we hope that we’ll be able to rescue them,” Vivek Pandey, ITBP, PRO, Uttarakhand told ANI.

Glacier burst in Rishi ganga power project heavy flow of water in low lying areas #flooding #rishigangadam #Chamoli pic.twitter.com/2ekhaQASpV

— Manish rai (@ra_i_manish) February 7, 2021

IMD said that there is no rainfall warning in the region for the next two days. Efforts are being made to ensure that all missing people are traced and accounted for, the Government said.

#WATCH| Uttarakhand: ITBP personnel approach the tunnel near Tapovan dam in Chamoli to rescue 16-17 people who are trapped.

(Video Source: ITBP) pic.twitter.com/DZ09zaubhz

— ANI (@ANI) February 7, 2021

When the going gets tough, the tough get going!@ITBP_official continues its rescue operation near Tapovan, #Joshimath pic.twitter.com/zxBRZyLTRr

— DD News (@DDNewslive) February 7, 2021

Nation

Most Covid Restrictions to be Lifted From March 31, Mask and Hand Hygiene to Continue

New Delhi-The Centre has issued a notification to the States informing that the provisions of the Disaster Management (DM) Act, 2005 will not be invoked in the country after March 31. The Union Health Ministry said that the use of face masks and following hand hygiene will continue.

It implies that most of the Covid-related rules and restrictions would end.

Union Home Secretary Ajay Bhalla issued the notification which said that the decision was taken following the overall improvement in the situation and the preparedness of the government in dealing with the COVID-19 pandemic.

However, local authorities and State police can still invoke fines and criminal cases against persons violating COVID-19 norms under the Indian Penal Code (IPC), a senior government official said.

The DM Act was invoked on March 24, 2020, due to the pandemic

“Over the last seven weeks or so there has been a steep decline in the number of cases. The total caseload in the country stands at 23,913 only and the daily positivity rate has declined to 0.28%. It is also worth mentioning that with the combined efforts, a total of 181.56 Cr vaccine doses have been administered,” the notification said.

“I would like to mention that in view of the nature of the disease, we still need to remain watchful of the situation. Wherever any surge in the number of cases is observed, the States/UTs may consider taking prompt and proactive action at a local level, as advised by MoHFW (Health Ministry) from time to time,” the notification said.

The Indian government had issued various guidelines and measures for the first time on March 24, 2020, under the Disaster Management Act to curb the COVID-19 situation in the country, which have been modified several times thereafter.

India currently has 23,087 active COVID-19 cases and recorded 1,778 new cases and 62 deaths in the last 24 hours. The daily positivity rate has also declined to 0.28%.

Nation

Vaccination of 15-18 Year Age Group in India from Jan 3, Precautionary Dose for Frontline Workers from Jan 10

New Delhi-India will begin vaccination of the children in the age group of 15-18 years from 3rd January 2022. The move is likely to aid in education normalization in schools. The announcement was made by Prime Minister Narender Modi on Saturday evening. He also announced a precaution dose (booster dose) for healthcare and frontline workers from 10th January 2022, Monday.

In India, this has been called the ‘precaution dose’ not booster dose. An option of precaution dose will be available for senior citizens above 60 years of age with co-morbidities on the advice of their doctors from 10th January 2022.

Referring to the Omicron infections In India, the Prime Minister requested the people not to panic and to follow precautions such as masks and washing hands repeatedly.

According to the Government, the vaccination campaign started on 16th January this year has crossed the mark of 141 crore doses, and 61 percent of the adult population of the country has received both the vaccines and 90 percent of adults have received one dose.

According to the Government statistics, currently, the country has 18 lakh isolation beds, 5 lakh oxygen supported beds, 1 lakh 40 thousand ICU beds, 90 thousand ICU and Non-ICU beds especially for children, more than 3 thousand PSA oxygen plants, 4 lakh oxygen cylinders and support to states is being provided for buffer doses and testing.

The Prime Minister assured that soon the country will develop a nasal vaccine and the world’s first DNA vaccine.

Photo by Nataliya Vaitkevich from Pexels

Nation

Three Farm Laws to be Withdrawn, Announces PM Modi Ahead of Elections in Punjab and UP

New Delhi: Ahead of assembly polls in Punjab and Uttar Pradesh, Prime Minister Narender Modi on Friday retreated from his stand on the three contentious farm laws and announced that the government will repeal three laws. He requested the protesting farmers to end the protest that has been going on for over a year now.

He said the three laws would be repealed in the winter session of Parliament starting later this month. He also said that though the laws were in the interest of the farmers, his government failed to convince them.

आज मैं आपको, पूरे देश को, ये बताने आया हूं कि हमने तीनों कृषि कानूनों को वापस लेने का निर्णय लिया है।

इस महीने के अंत में शुरू होने जा रहे संसद सत्र में, हम इन तीनों कृषि कानूनों को Repeal करने की संवैधानिक प्रक्रिया को पूरा कर देंगे: PM @narendramodi

— PMO India (@PMOIndia) November 19, 2021

The Prime Minister chose the occasion of Guru Nanak Jayanti to make this announcement. The decision is being perceived as an attempt to appease the farmers, especially in Punjab ahead of the assembly polls. Also, the results of by-poll held in various states are being seen as a setback to the ruling government that compelled it to reconsider its stand on the farm bills.

The Prime Minister said, “today I have come to tell you, the whole country, that we have decided to withdraw all three agricultural laws. In the Parliament session starting later this month, we will complete the constitutional process to repeal these three agricultural laws”.

It’s pertinent to mention that the Centre government had to announce a cut in taxes on petrol and diesel right after the results of bye polls were declared.

The three contentious bills are The Farmer’s Produce Trade and Commerce (Promotion and Facilitation) Bill, 2020, the Farmers (Empowerment and Protection) Agreement of Price Assurance and Farm Services Bill, 2020 and the Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Bill.

The opposition Congress and farmers’ bodies have termed it a victory of their unity against the government’s decision. Former Chief Minister of Punjab, Captain Amarinder Singh was one of the first to welcome the decision through a Tweet.

Great news! Thankful to PM @narendramodi ji for acceding to the demands of every punjabi & repealing the 3 black laws on the pious occasion of #GuruNanakJayanti. I am sure the central govt will continue to work in tandem for the development of Kisani! #NoFarmers_NoFood @AmitShah

— Capt.Amarinder Singh (@capt_amarinder) November 19, 2021

यह जीत देश के किसानों की जीत है, लोकतंत्र की जीत है।

किसानों की जीत ने स्पष्ट कर दिया है- भारत में कभी तानाशाही हावी नहीं हो सकती, आखिर तानाशाह को झुकना पड़ा।#जीता_किसान_हारा_अभिमान pic.twitter.com/A9psOtBGq8

— Congress (@INCIndia) November 19, 2021

Home Decor Ideas 2020

Home Decor Ideas 2020